DRAGONBALL EVOLUTION

In 2009 this summer will be the world's film competition. I would like to study here. Been April will present the film that will make us interested in the eyes DRAGONBALL EVOLUTION. This film recounts the Dragon Ball in the future. With modern technology and increasingly sophisticated. In this film is primarily the role pasri Sunggoku, Teachers turtle, Picolo, Bulma and other roles that play a role in this film DRAGONBALL EVOLUTION.

11:37 PM | Labels: NEW MOVIE | 3 Comments

Search Engine Optimization part2

To update regularly

By updating your content regularly, not only inviting a visitor to your site but also attract sympathy search engine. This provides opportunities for you to increase your site's ranking on search engines.

At the time you update the content, as much as possible to update the keyword, description and title. IM software for users such as blogger and wordpress, title is usually automatically update. But if you make a web, own blog, make a web / blog that automatically update the title, content, and the description at the time to update your web / blog. This can help alleviate the work you've done.

9:08 AM | Labels: TIP TRIK ADSENSE | 0 Comments

Search Engine Optimization part1

tempalte professional use

If you're confused design blog, on the internet there are lots of templates that good. Can be obtained from the free up to the pay. Enter keywords such as "b template" on Google you will have lots of free blog templates. At least this is a job to help you. So stay in the design.

Number of content

Try putting content in the size of the fitting. Do not be too small. Suppose in a page, there are only three lines only. This is very small.

For example, you have ads on the right side of the long-term. But a little of your content, does not reach 1 / 2 of the page that appears. This will feel very boring for your visitors. Sebijak may create a balanced composition that. If this happens a lot in the Blog / Web You, the visitor will be bored quickly.

10:08 PM | Labels: TIP TRIK ADSENSE | 2 Comments

OTHER THAN MONEY FROM ADSENSE

http://www.adbrite.com (ADBRITE)

http://www.targetpoint.com (ADPOINT)

http://www.kanoodle.com (BRRIGHTADS)

http://www.kontera.com (DYNAMICCONTEXT)

http://www.fastclick.com (FASTCLICK)

of the company, Google is still the largest. Strength giant Google is still dominating.

This is also not separated from the power of Google search engine is already famous.

Google's strength at this time is even called a pass giant!

At the time this book was written, Google is king. Google has upset the Yahoo

first considered as a giant. Throne has changed.

5:41 PM | Labels: GOOGLE ADSENSE | 5 Comments

money falls from the sky

No one believed the money falls from the sky. If you have money rain, the world will tremble. Do not rain money dikira of life will be good. Merebak wave of inflation to be everywhere. Prices bounced higher. Pleasure that will come only temporarily, will return as they are. The life of all the competition. money falls from the sky

Well, we do not have to discuss and imagine the money falls from the sky. But what if the money 'fall' from the Internet? You get money from the internet. Each month you will get the money someplace where. why either of which? Although you know the website, but you would not know where the office, the office phone numbers, who personnya contact. In short, you do not care. It is important, you get the revenue from the Internet.

Possible?

Currently, many opportunities to get money from the internet. Many people already feel the money from the internet. Not just one or one-time, but every month. Can be spelled out their lives each month from the Internet alias of them remain from the internet. What is happening?

There are many schemes memperolah revenue from the internet. One of them through Google Adsense. Adsense revenue from the scheme is what will be discussed in depth in this book. Other schemes can be learned by visiting the site at any time.

5:37 PM | Labels: GOOGLE ADSENSE | 0 Comments

WHAT IS GOOGLE ADSENSE

Adsense is one of the service from Google. Adsense moving in the area of online advertising. Adsense as online advertising agency. adsense such as online advertising agency. If the ad requires the media, the withdrawal magazines and newspapers, you are the owner media. Thus, the main requirements to obtain money from Google Adsense is to have websites and blogs.

3:33 PM | Labels: GOOGLE ADSENSE | 1 Comments

Play Bilyard

1. Doubtful, while still set the thrust of the strategy will also halt.

2. Bilyard sticks, forget coat with chalk sticks end result will poke.

3. Focus poke, poke the effects will never be straight directions.

4. Direction poke, poke one direction causes the diincar target is not reached.

5. Biliard position sticks, sticks base biliard picked rada high tend to make poke fumble.

6. Bridge, the bridge that does not lead to stable direction poke disrupted.

7. Standing position, the body that result in energy shaky poke so weak.

8. Execution poke, poke, which was not done with diligence will not be the maximum.

9. Gestur body, the intention of posing after poke membuyarkan concentration.

10. Strength poke, poke the ball fast, making it difficult biliard entrance hole

1:43 AM | Labels: SPORTS | 6 Comments

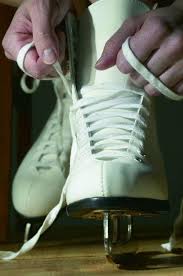

ICE SKATING

Ice skating in Cambridge or any other part of UK is a fun and perfect pastime for hundreds of thousands of people and if you have any interest in skating or just want to utilize your free time or your winter vacation for learning some sporting activities, ice skating in Cambridge is perfect sporting event for you.

Ice skating in Cambridge or any other part of UK is a fun and perfect pastime for hundreds of thousands of people and if you have any interest in skating or just want to utilize your free time or your winter vacation for learning some sporting activities, ice skating in Cambridge is perfect sporting event for you.

Ice skating in Cambridge is available at many rinks and people can get tickets online booked by paying through their credit cards. Some of the ice rinks provide many offers and special discounts for people and if you are looking for a best opportunity to entertain and enjoy your winter vacation on least expenses, ice skating in Cambridge rink is one of the best options for you.

1:34 AM | Labels: SPORTS | 0 Comments

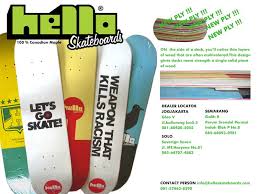

SKATE BOARD

The perfect skateboard is not the only thing you need in the activity. In fact, it is only a part of the gears you need. The offer half is completed by the gadgets which make skateboarding a safe sport for you. Although well-seasoned pros make skateboarding seem so easy, they are still at risk for injuries. Therefore, being responsible through wearing of protective gears is a must.

The perfect skateboard is not the only thing you need in the activity. In fact, it is only a part of the gears you need. The offer half is completed by the gadgets which make skateboarding a safe sport for you. Although well-seasoned pros make skateboarding seem so easy, they are still at risk for injuries. Therefore, being responsible through wearing of protective gears is a must.

The Head

Protective head gears are one of the most important equipment in skateboarding. The helmet needs to fit well on every side of your head. It should protect the front, the sides, and the back part so you can be safe in case of injuries. Some helmets have special padding which prevents sweat from getting to the forehead. Although these gadgets may be expensive, they can provide the ultimate protection you need. Be sure to wear one while skateboarding. It can greatly reduce the risk of severe head injuries.

The back part of your head should be covered properly with the helmet. The front part should be cushioned as well. If serious accidents will happen, your head can still be safe. The risk of getting injuries will greatly lessen through the use of these protective gears. Having the right type of helmet is very important to make skateboarding a safe activity for you.

Deck Size

There are important factors when choosing deck size. Aside from bodily proportions, you need to base your choice on the tricks you want to achieve with your skateboard. The average deck size is around 7 to 8 inches. The deck size provides a huge difference on your skateboarding skills.

Quality Of The Deck

Although buying cheaper decks can be enticing, you wouldn't want to invest on something which will wear down easily. If you want something that can last for a lifetime, be sure to choose a deck size that is of high quality. You will gain more from investments which have a higher quality. Although you may have to pay more, you get to keep the gadget for a very long time. You will also find the deck more durable and stable if made under superior quality.

1:09 AM | Labels: SPORTS | 0 Comments

When Alcohol Testing Devices are not a Joke

Professional Alcohol Testing Devices Today

A DOT, Department of Transportation, professional breathalyzer is approved by the United States. It must meet certain criteria to be considered legal and its results must be able to stand up in court. Professional alcohol testing devices are made of durable materials and come with disposable breathalyzer mouth pieces people blow into. Professional alcohol testing devices like the DOT breathalyzers measure exactly the amount of alcohol that is in your blood through your breath, your blood alcohol content, BAC using advanced semiconductor sensors that are extremely accurate.

Professional alcohol testing devices, like a breathalyzer need to be calibrated frequently and should be checked often for consistency. Playing around with a keychain type breathalyzer is fun, but it shouldn’t be your guide telling you whether or not you should get behind a wheel of a car. Would you trust your life against anything less than a professional alcohol testing device? There are not many alcohol testing devices which results stand up in court. Not all alcohol testing device results are trusted by the U.S. courts.

Here Are A Few Alcohol Tests That Will Stand Up In Court:

• BAC, blood alcohol level from a certified, professional Breathalyzer

• Hair alcohol test from a certified hair alcohol testing lab

• Urine alcohol testing results from a certified lab

Alcohol Tests That Will Not Pass in Court

• Non-certified breathalyzer results

• Hair sample not sent from a lab

• Contaminated urine alcohol test

• Any test from a non-certified hair alcohol device

Playing around with a toy breathalyzer is fun for sure, but it is exactly that- just a toy. No one should trust their life with the results from any cheap “keychain” model breathalyzer. Even if it looks professional and perhaps the model is used by law enforcement, only certified professionals are allowed to accurately test an individual’s intoxication level. It’s not just how much a person has had to drink, a lot depends on the height, weight and drinking habits of the individual. If the legal limit in your state says .08 percent, that doesn’t mean 0.8 percent is okay for everyone- you could still be certified as drunk even if you are below that percentage. Think smart and don’t over do it. When it comes to legal and certified alcohol testing results, only a few tests really matter. It’s not worth it to test your luck on if the party breathalyzer is right.

10:24 PM | Labels: HEALTHY | 0 Comments

Comcast Cable TV and Phone Specials

There are many things to look forward to every month - spending time with your spouse and children, going to the movie theater, and eating out with friends at a favorite restaurant. But one thing none of us likes doing each month is paying bills. Most people dread writing endless checks and sorting through all the envelopes they have. After mortgage or rent payments, the biggest expense you face may be your cable, broadband, and telephone bills. Every year each one gets larger and larger. Well now you can order all your services in a bundle from Comcast Communication and you will no longer have to pay sky-high bills to separate companies. Enjoy all three services at an unbelievably low monthly fee. What does the very low price get you? Continue reading, and you may be pleasantly surprised.

One Low Price and Three Great Services

Why should you use Comcast to bundle your telephone, internet, ad entertainment services into one bill? Comcast combines all three together to give you the lowest price possible, lower than any other company. You not only save money, but Comcast through their offering of broadband, phone, and cable services delivers the latest technology and the highest support for their customers without going up on their rates. Just sit back and relax and enjoy the best telephone service available, as well as the best entertainment offered today. Now if you happen to be interested in just one of the services that Comcast has to offer, that's alright too. Another option is to purchase individual services, therefore taking full advantage of Comcast's bundled savings. Here's a run down of every service and why Comcast is tops.

10:18 PM | Labels: TECNOLOGY | 0 Comments

Ohio Health Insurance --- Free Ohio Health Insurance Quotes

Free Ohio health insurance quotes are now being offered at www.EasyToInsureMe.com We only represent top rated Ohio health insurance companies

such as Anthem Blue Cross Blue Shield Ohio , Medical Mutual of Ohio , Aetna , Celtic , Humana, and Golden Rule .

The Ohio health insurance companies can be accessed by using the easy to use Easy To Insure ME quote engine. Simply put in your Ohio zip code. After this is done the Ohio resident can compare every Ohio health insurance plan available to them. Once the Ohio resident has chosen a plan they can choose to apply online or download an application for immediate Ohio health insurance coverage. Easy To Insure ME also provides information for free health insurance

in Ohio. This can be found in the HealthCare Focus section of the site. The two free Ohio health insurance plans are called Healthy Start and Healthy Families.

Free Ohio health insurance consultations will be done over the phone between the hours of 9 a.m. to 9 p.m. Feel free to call Chad Levin the owner of Easy To Insure ME at 215 944 3079. Or email them at easytoinsureme@aol.com

Thank you for your trust and confidence Ohio.

www.EasyToInsureMe.com

Benefits of working with EasyToInsureMe.com

We are your local insurance broker offering free online health insurance quotes for Ohio Health Insurance. View and compare Ohio health insurance quotes in 30 seconds. Ohio residents can buy Ohiohealth insurance , apply online and get coverage today. Choose from a variety of Ohiohealth insurance plans and health insurance deductibles. Compare Ohiohealth insurance quotes , Ohio health insurancebenefits , and Ohiohealth insurancecompanies side by side. Choose from HMO , PPO , HSA plans. Enjoy low cost health insurance in Ohiothrough our quoting system. View and Quote the best Ohiohealth insurance rates available - our rates are the same as the ones you can get directly from the insurance company - nobody has a better price. Also available are Ohio health insurance quotes by phone. (call Easy To Insure ME 215 944 3079) We offer the most competitive Ohiohealth insuranceplans available to all consumers showing only quality Ohiohealth insurance. Our agency knows every Ohiohealth insurance plan in the states of Ohio. We also know every Ohiohealth insurance plan by the counties of Ohio.

5:01 PM | Labels: INSURANCE | 0 Comments

American Life Insurance-one of the Most Trusted Company

American Life Insurance the most trusted company which has a reputation of about 87 years. This company is one of the globally recognized life insurance companies and it has a number of branches all over the world which has a vast customer line following. American Life Insurance gives various tax benefits to all its insurance policy holders and it also takes care of all your life insurance related policies like retirement insurance policy, wealth management policy, medical insurance, health insurance etc.

Life insurance basic terms as you know is an important factor in every person's life and when it comes to life insurance age is not the main criteria when it comes to get your life insured. American Life Insurance also known as AIG insurance company and majority of Americans has insured themselves with this life insurance company. The market value of this company is high and you can find the companies ratings in the financial books due to their vast financial transactions with other financial institutes.

There are two major life insurance policies that this AIG Insurance Company deals with i.e. the Term Life Insurance and Whole Life Insurance. In case of Term Life Insurance the policy taken is for a short period of time and Whole Life Insurance is where you get yourself insured for your whole life.

AIG insurance company is one such life insurance company that charters to the needs of the common person. One of the benefits of getting insured in this life insurance company is that you reap a rich harvest of life insurance benefits on all your life insurance policies which no other life insurance company provides you as this company provides you with the benefits when you are still alive.

This life insurance company in order to increase its relationship with their vast flowing customer's have started life insurance online services which has made it easy and convenient for them to get themselves and their family members insured staying within the very comforts of their own house. AIG Insurance is one of the most sought of companies and it is a tough competitor to other life insurance companies.

5:00 PM | Labels: INSURANCE | 0 Comments

Irish Construction Insurance

One of the most interesting facts about the Irish Construction industry is that there is no legal requirement for a construction company to hold any from of construction insurance! In fact, the only insurance an Irish contractor is legally obliged to have is basic motor insurance on his/her motor vehicles!

Although there is no legal requirement under Irish law for a contractor to hold adequate Construction Insurance it is extremely important that adequate cover is in place.

One of the most important reasons is the high injury & mortality rate on Irish Construction sites. One major positive of the recent construction boom is the fatality per thousand ratio has fallen in recent years although it is still at an unacceptable level.

For example, in 2001 28% of workplace fatalities were Construction related and the Irish Construction industry is consistently second only to the Irish Agriculture& Forestry Industry.

As many primary contractors require their subcontractors to hold Construction Insurance the reality is that although Construction Insurance is not a legal requirement it is usually a prerequisite to obtaining work on the majority of the countries construction sites so the need for construction insurance is a necessity in everything but law!

Although Construction Insurance is quite a complex field the four main areas of cover are as follows:

• Public Liability Insurance

• Employers Liability Insurance

• Contractors All Risks

• Personal Accident

Public Liability Insurance

Public liability insurance [PL] provides cover in the event that the policyholder is sued by a third party who feels that they have suffered injury or loss as a result of the policyholders negligence (lack of care).

Consider the following examples where Public Liability Insurance will provide cover:

• You run a plumbing company. One day you are called to an office to sort out a problem in their kitchen. Accidentally, you burst a pipe, and flood the office. Your client then makes a claim against you for the damage to their carpet and computer systems which have been damaged by the water.

• You are a building contractor. While walking along scaffolding one of your men drops a piece of equipment which falls to the street, injuring a passing pedestrian. The pedestrian makes a claim against your firm.

Obviously these are very simplified examples and we haven’t discussed the complexities of Products Liability/Liability Law/Duty of Care etc however it should provide a basic understanding of Public Liability Insurance.

Employers Liability Insurance

Employers Liability Insurance [EL] provides cover if any of your employees suffer physical injury or death, and it is proven that as an employer you acted negligently and subsequently could have prevented their loss. If they then decide to pursue you for compensation the insurer will pay the cost of the claim.

Consider the following examples where Employers Liability Insurance will provide cover:

• You run a carpentry company. One of your employees loses a finger while using a chop saw and decides to claim against you for his injury

• You are a scaffolding contractor and are erecting scaffolding around an apartment block. While erecting the scaffolding one of your employees falls and suffers severe bodily injury. He decides to claim against your firm.

Please note that Public & Employers Liability is offered ‘hand in hand’, that is when arranging construction insurance you will need to arrange both Public Liability & Employers Liability Insurance together [Also known as Combined Liability Insurance] as Employers Liability Insurance is not available on a ‘Stand Alone’ basis..

Contractors All Risks Insurance

Contractors All Risks insurance (also known as Contract Works insurance) is an insurance policy specially designed for builders and a number of other trades working at a contract site. Contractors All Risks insurance can include cover for contract works, own plant, hired-in plant and employee's tools. The main part of the contractors all risks insurance is the contract works section which provides cover for the property being worked on (e.g. new house, etc.). However, cover for the existing property is excluded (e.g. the existing structure when building an extension) and must continue to be insured under its own insurance cover.

Consider the following examples where Contractors All Risks Insurance will provide cover:

• You are a building contractor and are building a house for resale. So far you have spent €200,000 on materials and labour. The property catches fire and is destroyed before it has been completed. • You are groundwork’s contractor and are presently digging foundations for a new housing development. Naturally you leave your excavator on site until the contract is completed however one night your excavator is stolen.

Personal Accident Insurance

Personal Accident Insurance [Also known as Income Protection Insurance] is highly recommended for a sole traders, business partners and company directors as a combined liability policy does not cover any injury caused to a sole trader/business partner while it is extremely difficult for a company director to sue his/her own company. A policy can be tailored to your exact needs and policies include a tax free monthly benefit, a lump sum [capital benefit] and hospital cash.

Consider the following examples where Personal Accident Insurance will provide cover:

• You’re a self employed carpenter with no employees. You cut your hand and are unable to work for eight months. As you have Personal Accident cover you receive a tax free benefit of €1,500 after one month and continue to receive this amount until you return to work.

• Although Personal Accident/Income Protection insurance is no substitute for full time earnings it will provide you with an income if you are unable to earn and it will reduce your financial worries at a time when your recovery should be your number one priority.

Machinery & Plant Insurance

Machinery & Plant Insurance is normally arranged on a case by case basis and provides Accidental Damage Fire & Theft Cover on Machinery. This policy is normally taken by contractors who wish to cover a specific number of items.

Health & Safety Executive

In Ireland the HSE [Health & Safety Executive] have the ultimate authority over Construction Sites and have the ability to close a site if they feel it is a safety hazard. Their primary initiative is the ‘Safe Pass’ – a one day site safety training programme.

Who needs to do Safe Pass awareness training?

Safe Pass is a one-day safety awareness programme aimed at general construction workers, craft workers and "on site" security personnel in the construction industry. The aims of the programme are to:

• raise the standard of safety awareness in the construction industry

• ensure that site personnel after completing the one day awareness programme can make a positive contribution to the prevention of accidents and ill health while working on the site

• maintain a register of personnel who have received training

• provide participants with a FAS Safe Pass registration card, indicating that the holder has attended a formal course in health and safety awareness

Under the Safety Health and Welfare at Work (Construction) Regulations 2006 Safe Pass / Safety Awareness Programmes applies to -

(a) craft and general construction workers,

(b) persons undertaking on-site security work, and

(c) persons or classes of persons as may be prescribed by the Minister.

For more information on Irish Site Safety please visit the website of the Health & Safety Authority www.hsa.ie while for more information relating to Irish Construction Insurance please visit the website of Keystone Insurance www.keystone.ie, Ireland’s premier supplier of Construction Insurance

5:00 PM | Labels: INSURANCE | 0 Comments

Buying Life Insurance After Being Diagnosed With Cancer

The American Cancer Society estimates doctors will diagnose over 1.4 million new cases of cancer in the U.S. in 2007, with more than 559,650 cancer-related deaths. If you are among the majority of cancer patients and survive for at least five years following your diagnosis, you may face another fight: buying life insurance

.

Buying life insurance for cancer patients is challenging, but not necessarily impossible. Your chances for securing a policy depend greatly on the type, stage and grade of the cancer, and even on the treatment plan. There is a relationship between the rate you'll receive and the curability of your cancer. Certain types of skin cancer, for example, are considered very low risk by life insurance companies and a skin cancer history may not even impact premiums.

Applicants with common and treatable forms of breast and prostate cancer may be able to get a "standard" rating under ideal circumstances. But patients with a history of leukemia or colon cancer may fall into a "substandard" or "high substandard" rating at best, or receive declines. Anyone with cancer that has metastasized likely won't be able to obtain a policy.

Dr. Charles Levy, senior vice president and chief medical director of AIG American General Domestic Life Insurance Cos., says, "We're better and better able to differentiate the risks of individual cancers." Life insurers like AIG American General have sophisticated tables to determine premiums, where they can factor in cancer types and treatments. The end result is better premiums because applicants aren't lumped together as an "average."

Most insurers will not offer a policy to someone who is still undergoing treatment for cancer. Depending on your type of cancer, the life insurer may also want to add a surcharge, also called a temporary flat extra. For example, AIG American General sometimes charges temporary flat extras for two to five years, depending on the applicant's cancer and treatment. The good news is that although these extra premiums can be expensive, they will automatically disappear after a set period of time.

Cancer insurance risk specialists

While a dedicated life insurance agent will search cancer insurance companies to find insurers that will sell you a life insurance policy, in some cases you may be better off seeking out a broker who specializes in finding life insurance for people who have a history of cancer.

These brokers will know the specific questions underwriters will want answered when considering your application. Many brokers have developed relationships with several insurers, so they know which companies offer the best-priced life insurance policies for cancer survivors. Some brokers have experts who specialize in gathering your medical records and organizing them.

By directing your application to life insurers that will view your application most favorably, these brokers will help you find the most accurate price quotes and the lowest premiums for life insurance. Always check the financial strength of the insurer before you buy any policy and be sure that the agent or broker you choose is licensed in your state.

Life insurance strategies for cancer survivors

If you are a healthy cancer survivor, life insurance is even more feasible. There are things you can do to ensure you're getting the best premium offers possible for your situation.

1. Gather all possible medical records before you apply, from the first pathology report to medical records to treatment records. That ensures medical underwriters have the most complete picture of you, your health, and your cancer history. Having all those records before you apply for cancer insurance will reduce delays in your application process, because your life insurer is going to request them and will wait for them. The information you provide can garner you better premiums in the end: The less life insurer underwriters knows about you, the more likely they are to have to assume you are the highest risk and offer you high premiums accordingly. According to Levy, "If it's fuzzy, we're more likely to err on the side of conservatism."

2. Make sure you have complied with your doctor's treatment plans. For example, says Levy, if your doctor asked to see you back in one year and you haven't been back in four years, get to your doctor for your check-up before you apply for life insurance. Your life insurer is not going to offer you a policy without before seeing the results of that check-up. Similarly, if you've had breast cancer and you're due for a mammogram in December and you apply for cancer insurance in October, your life insurer will likely wait for the results of your next mammogram.

3. Get prices from several companies. Policy costs can vary a great deal among companies.

4. See if you can get group life insurance through a professional, fraternal, membership, or political organization to which you belong.

5. Consider a "graded" policy (one with limited benefits) if you cannot get full death benefits. In the first few years of a graded policy, the company pays only the premiums and part of the face value if the insured person dies of a condition, such as cancer, that existed before the policy took effect. If the insured person dies after the specified grading-in period, the company will pay the full face amount of the policy.

If your cancer has been successfully treated, and you are otherwise in good health, you can likely obtain a cancer life insurance policy. If you can show that you are healthy and your treatments have gone well, several insurers may compete for your business.

4:59 PM | Labels: INSURANCE | 0 Comments

How to Collect on Lost Life Insurance Policies

A relative has just died. He had a life insurance policy with you listed as the beneficiary. There's just one problem: the life insurance policy is missing. You have no idea which insurance company wrote it.

If you find the missing life insurance policy in the future, are you still eligible to receive the death benefit?

Hope they paid their insurance bills

If you're a beneficiary and you find the lost life insurance policy shortly after the insured dies (within six months to a year, for example), claiming the death benefit should be trouble-free.

First, determine if the insured had term or permanent life insurance. If the insured held a term policy, you'll receive the death benefit if he died before the end of the policy term. If he died after the policy expiration date, you would get nothing.

If the insured had a permanent life policy, you'll receive the money if the death occurred while the policy was "in force," meaning all premium payments were made up until the time of death. If the death was a while ago, you'll receive the benefit with interest from the date of death.

If the life insurance policy lapsed — meaning the insured stopped making premium payments before he died — there's a chance you might get nothing. When a permanent life insurance policy lapses, most insurance companies switch its status from permanent insurance to one of two options:

"Extended term" — The insurance company uses the cash value of the policy to buy a term life insurance policy for the same death benefit using the cash value of the policy. The death benefit will continue for the longest period the cash value will purchase.

"Reduced paid up" — The insurance company will keep the policy in force permanently, but will reduce the death benefit.

Gerry Brogla, an actuary for State Farm, says in the majority of the cases at his company, the permanent policy continues as extended term if it lapses. At State Farm, extended term is the default option for most permanent policies.

If the policy lapses, and the extended-term period expires before the insured dies, the policy is worthless and the life insurance beneficiary will get nothing. If the insured dies before the extended-term period is up, the beneficiary will receive the death benefit. If the policy lapsed because the insured died (thus ending premium payments and causing the insurance to be placed in extended-term status), the beneficiary will still collect the full death benefit, regardless of when the extended term was up. The beneficiary always needs to supply the insurance company with a death certificate to verify the date of death.

There is no time limit during which a life insurance beneficiary must step forward to collect the money, according to Jack Dolan, spokesman for the American Council of Life Insurers. "If a person shows up 30 years after [the insured's] death, the company still makes good on it," Dolan assures.

What happens if no one ever reports the death?

If the insured dies and the insurance company does not learn of the death, the policy lapses. Insurance companies will take steps to find out why a policyholder stopped making payments.

When an insurance company stops getting payments, it sends letters to the insured informing him the policy may lapse as a result of unpaid premiums. If the letters go unanswered, the company might initiate a search to find the insured. If that comes up empty, the company will then lapse the policy.

If a beneficiary to a policy never steps forward, it unfortunately means the insured paid money to a policy throughout his life and his beneficiaries never see a penny. This is why its a good idea to make sure beneficiaries are aware of any life insurance policies you have.

If you're lucky, the state may have your money

In some cases when a beneficiary fails to claim a death benefit for several years, the money is transferred to the state where the insurance policy was purchased under the escheat laws.

If a company knows an insured died and it cannot find the beneficiary, it must turn the full death benefit over to the state comptroller's department within three to five years of the insured's death. The money is transferred to the state where the insured bought the policy. The money is considered "unclaimed property" and gets lumped in with dormant bank accounts and uncollected rent deposits. The comptroller's department maintains a database that lists the names and addresses of lost life insurance beneficiaries.

Many states will try to contact life insurance beneficiaries in an effort to pay the death benefits. In Texas, for example, the names and addresses of the beneficiaries are published annually in each county in the state. In New York, the Web site of the New York State Comptroller's Office of Unclaimed Funds has an online search to find any unclaimed death benefits owed to you. You can find out the procedures in your state by contacting the office of your state comptroller or treasurer.

Keep in mind your chances of finding the policy with the state are slim. The insurance company has no obligation to hand the money over to the state if it's unaware the insured died. In most cases, it's the beneficiary who contacts the insurance company.

Also, the insurer only transfers the money to the state three to five years after it cannot find the beneficiary but knows the insured died. If the state doesn't have the death benefit, it's likely the insurer is still looking for the beneficiary or doesn't know the policyholder has died.

Unclaimed death benefits are rarely transferred to the state. Dave Potter, a spokesman for Hartford Life, says less than 1 percent of his company's death benefits go unclaimed.

Del Chance, a life insurance claims manager at State Farm, says, "Turning over life policy benefits to an individual state after the death of an insured is extremely rare. State Farm utilizes their own search techniques as well as outside vendors to locate lost beneficiaries in the event of the death of one of our insureds. By and large these procedures have always located the beneficiary.

Tips for making sure your life insurance beneficiaries get your death benefit:

1. Give your beneficiaries your policy information. It can be a difficult and awkward conversation, but an important one.

2. Keep all your financial records (especially your life insurance policies) in one place. Don't force your beneficiaries to search your house from top to bottom after you die.

Tips for looking for lost life insurance policies:

1. Go through canceled checks or contact your relative's bank for copies of old checks. Look for checks made out to insurance companies.

2. Ask those who may have known about your relative's finances

. Speak with the relative's lawyer, banker or accountant. Also contact the relative's insurance agent.

3. Contact your relative's past employers. They might know of possible group life insurance. The insured might have also purchased supplemental life insurance through work.

4. Check the mail for a year. Premium bills and policy-status notices are usually sent annually.

5. Look at income tax returns for the past two years. Check for interest income from policies or expenses paid to life insurance companies.

6. Contact the Medical Information Bureau. If your relative bought life insurance fairly recently, there might be a trail of the companies to which he applied. The Medical Information Bureau (MIB) maintains a database that might show if insurers requested your relative's medical information within the past seven years. Record searches can be requested through the MIB's Policy Locator Service and cost $75. The MIB says that nearly 30 percent of searches turn up leads.

4:57 PM | Labels: INSURANCE | 0 Comments